As of the writing of this article, the Coronavirus pandemic is only a few weeks old, yet it is clear that this event is already having a significant impact on the travel industry. The World Health Organization (WHO) has declared the virus, now known as COVID-19, a global health emergency, and individual governments have imposed travel restrictions and other measures, principally directed at travellers arriving from China. To gain some perspective on the potential impact of the current Coronavirus scare on the lodging industry, this article looks at the SARS pandemic of 2003, which has strong parallels to the current Coronavirus situation. Both originated in China, and the diseases are similar in terms of symptoms, severity, and transmission. The SARS impact will be considered from two perspectives: how a pandemic scare can affect an individual market, and the broader impact on international travel.

The SARS Outbreak of 2003

Severe Acute Respiratory Syndrome (SARS) was first reported in Asia in February 2003. Based on further research, the earliest case dates to November 2002, while the last cases were reported in June 2003. During that period, a total of 8,098 cases were reported; of those cases, 7,324 people recovered, and 774 people died. Although the virus appeared in 37 countries, the majority of the cases were in Asia. The only country outside of Asia to report a significant volume of cases was Canada, and most of these were in the greater Toronto area.

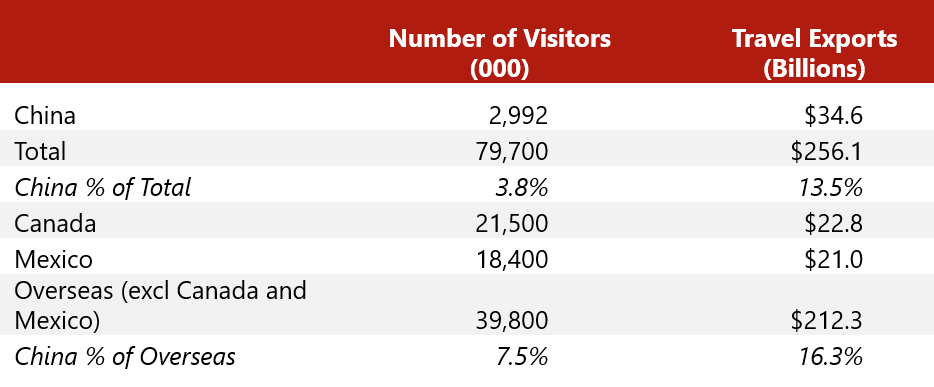

International Travel to the U.S. by Country of Origin – 2018

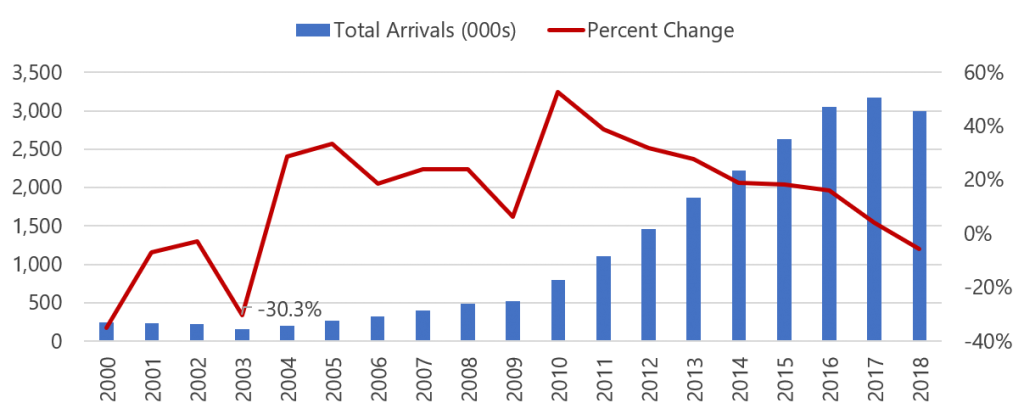

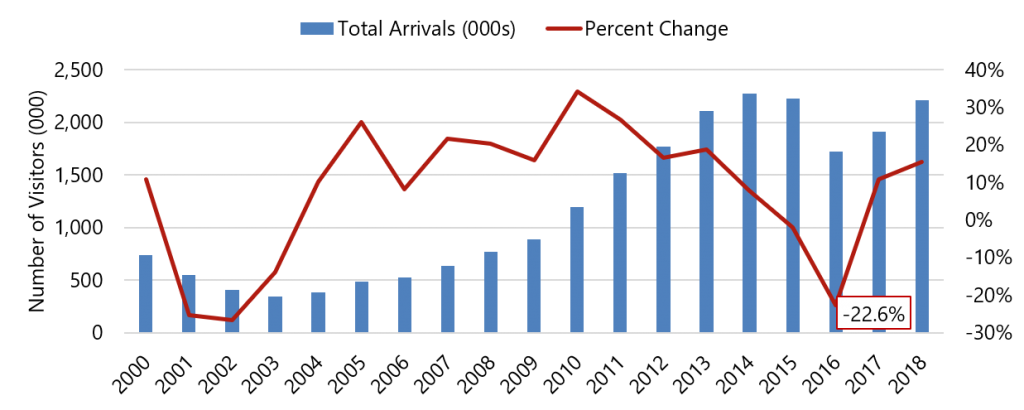

The data for 2018 reflect a 5.7% decrease in the number of visitors and a 2.2% decline in travel exports from 2017 levels. Statistics for the year-to-date through October 2019 period indicate a similar decline. The recent drops in Chinese tourism have been widely attributed to the trade wars with China. Nevertheless, the current level of visitation is over ten times greater than the number of visitors from China in the early 2000s, as is illustrated by the following graph.

Total Arrivals to U.S. From China

In terms of spending, the 2018 total of $34.6 billion is almost 15 times the $2.3 billion total spending by Chinese visitors to the U.S. recorded in 2002.

Impact of SARS on Inbound Travel to the U.S. from China

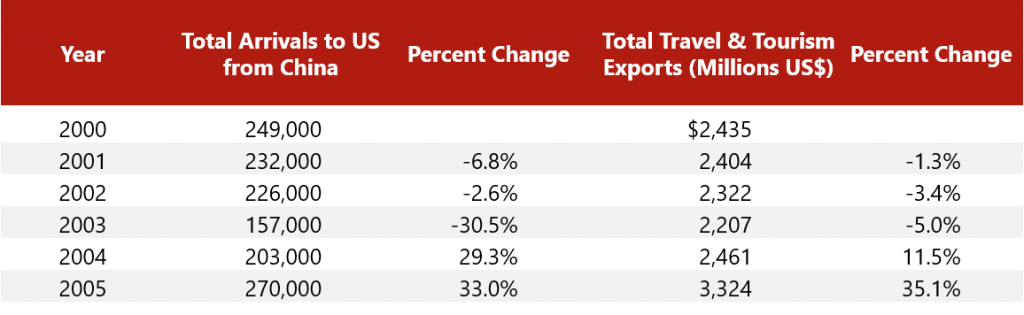

The following table presents the number of Chinese travellers and total travel and tourism exports over the period from 2000 through 2005, illustrating the impact of the 2003 SARS pandemic on travel.

Chinese Tourism and Spending 2000 – 2005

Concurrent with the SARS pandemic, the number of arrivals to the U.S. from China dropped by over 30%, or 69,000. By 2005, the volume of arrivals had surpassed the earlier peak, and the value of travel and tourism exports to China had increased by $1 billion over pre-SARS levels.

Impact of Zika Virus on Inbound Travel to the U.S. from Brazil

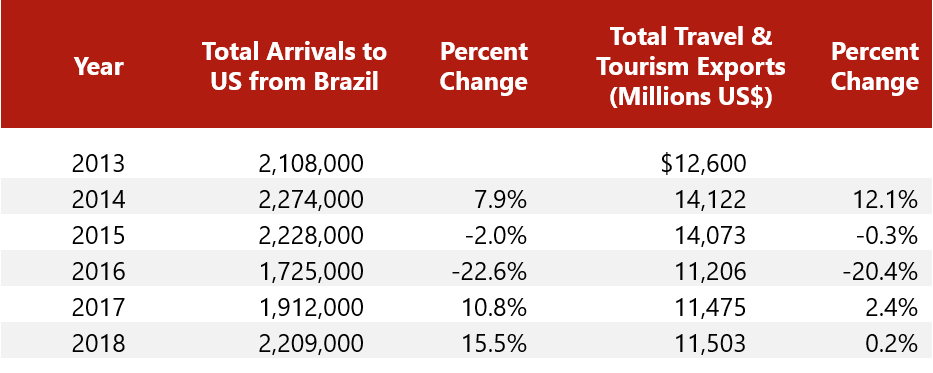

The following table illustrates the impact of the Zika virus on the number of Brazilian travelers and total travel and tourism exports over the period from 2013 through 2018, illustrating the impact of the Zika virus pandemic on travel.

Brazilian Tourism and Spending 2000-2005

Looking at the Zika virus pandemic, in 2016, the year of the outbreak, the number of arrivals to the U.S. from Brazil dropped by 22.6%. This is less dramatic than the 30.3% decline during SARS. Moreover, the Zika virus outbreak coincided with a downturn in the Brazilian economy, as evidenced by the Brazilian GDP, which fell by 3.6% and 3.4% in 2015 and 2016, respectively. The economic challenges no doubt contributed to a decline in travel, and the limited recovery in total spending can also be at least partially attributed to this factor, as well.

Total Arrivals to U.S. from Brazil

Impact of Coronavirus on Travel

The full impact of the coronavirus on international travel will depend on the extent of the pandemic and the duration of related travel restrictions. The response of the public, the “fear factor,” will also influence the total impact, particularly with respect to the periods after the travel restrictions are lifted. Clearly, however, there is much more at stake than was the case in 2003. If the SARS impact were to be repeated, a 30% decrease in the number of visitors equates to 900,000 fewer travellers, and a 5% decrease in spending equates to $1.7 billion.

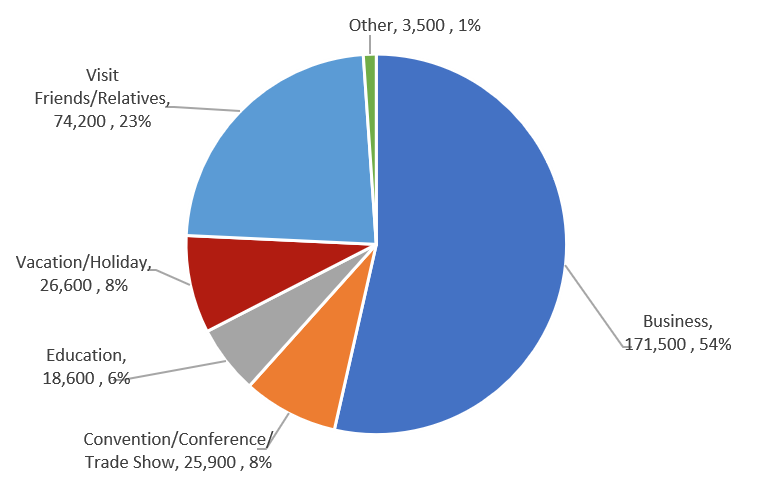

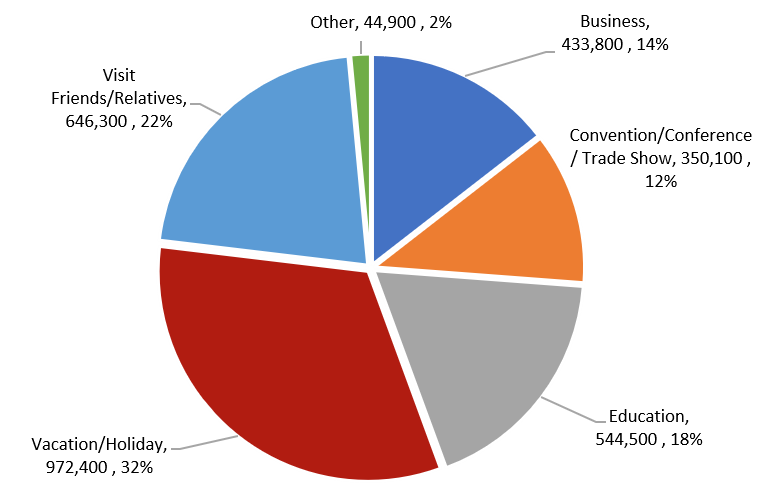

However, the profile of Chinese travellers to the U.S. has changed significantly in the intervening years. The following chart illustrates the breakdown of visitors by primary purpose of trip. To illustrate the traveller profile in the early 2000s, we have used data for 2005, the earliest year for which the detailed breakdown is available. The “Other” category includes health treatment, religious pilgrimages, and other reasons for visitation that are not depicted in the chart.

Main Purpose of Chinese Travel to U.S. – 2005

Main Purpose of Chinese Travel to U.S. – 2018

All segments will be affected during the period in which travel restrictions are in effect. How quickly each segment recovers once the restrictions have been lifted will likely differ, depending on the purpose of the trip. Business travellers are likely to be among the first to resume traveling, as the lull in travel will presumably make resuming their business activity a priority. The Vacation/Holiday category and the Visit Friends/Relatives category both reflect travel that is typically discretionary. As a result, the timing and pace of the recovery of these segments will likely be more influenced by the perspective of individual travellers. On a positive note, a significant proportion of the Vacation/Holiday segment comprises group tours, and the entities that run these tours can be expected to push to restore their businesses as soon as possible. Finally, the Education segment is the least likely to be affected, largely for reasons of logistics. Given the timing of the outbreak, it is reasonable to assume that most Chinese students attending U.S. schools were already here, and they are unlikely to return to China during the semester or even over the summer. Thus, unless the outbreak and restrictions continue until the fall semester, this segment will likely demonstrate minimal impact.

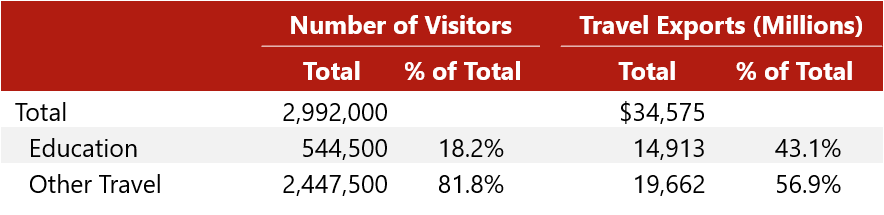

Turning to the question of economic impact, the outlook for the education sector suggests some good news. Although individuals traveling for education represented only 18.2% of total travellers in 2018, the value of their spending comprised over 43% of the total travel exports. To the extent that impact on the education sector is minor, so too would be the impact on the spending by these travellers. However, the remaining $19.7 billion in travel exports is generated by all other sources of travel (further breakdowns are not available) and would be vulnerable to impact on the segments that comprise this category.

Inbound Travel to the US from China: Visitors and Spending 2018

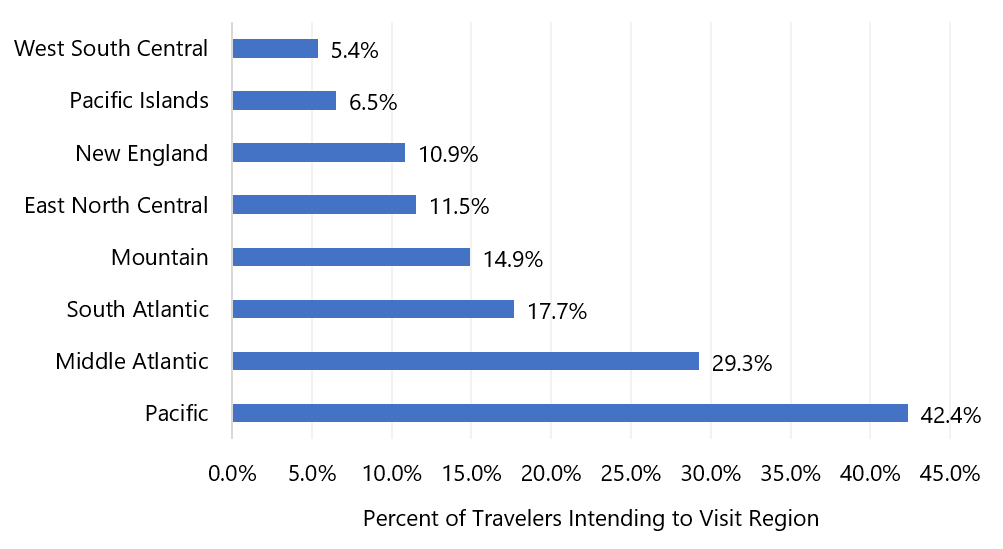

Just as certain segments may be more vulnerable to the impact of the pandemic, certain regions of the U.S. are also more likely to be affected. The following graph illustrates the breakdown of visitors by regions visited. Some visitors’ travel plans included multiple destinations, accounting for the total of greater than 100%.

2018 Inbound Chinese Travelers – Destination by Region

While Chinese tourists visit all regions of the country, the Pacific and Mid-Atlantic regions are the most popular destinations. Within the Pacific region, most visitors indicated Los Angeles (23.4%) and San Francisco (14.1%) as their primary destination. New York City was cited as the destination by 24.5% of the 29.3% of visitors to the Mid-Atlantic region. Within the other regions, the major metropolitan areas were the primary destination, including Las Vegas (10.3% of the Mountain region), Boston (8.8% of the New England region) and Washington, D.C. (7.6% of the South Atlantic region).

Another factor that warrants consideration is the length of stay. Given the distance to the U.S. from China, most visitors plan a relatively long trip. According to a McKinsey & Company report entitled Chinese Tourists: Dispelling the Myths, published in September 2018, 55% of Chinese visitors stay eight to 13 days, and 21% stay for longer than 13 days. Based on the data, every visitor that does not travel to the U.S. due to the pandemic could equate to multiple room nights, exacerbating the impact on the hotel industry.

Conclusion

Ultimately, the impact of the coronavirus on the global travel industry will depend on the course of the pandemic, the extent and duration of travel restrictions and, perhaps most significantly, the media’s coverage of, and the traveling public’s response to, these events. Clearly, the U.S. lodging industry and other sectors that benefit from travel and tourism will be negatively affected; some markets are already feeling this impact.

Over the longer term, however, the outlook is more optimistic. As is illustrated by travel patterns following prior pandemics, the volume of travel can recover relatively quickly. Moreover, China continues to be a significant source of tourism for the U.S., with the potential to generate substantially more visitors and economic impact than recorded in recent years. As the trade issues continue to be resolved, the U.S. can expect to participate in this expanding market.

Leave a Reply